Montreal, QC, February 05, 2024 — Ecolomondo Corporation (TSXV: ECM) (OTCQB: ECLMF) (the “Company” or “Ecolomondo”), a cleantech company that designs, builds, operates and commercializes Thermal Decomposition turnkey plants using its proprietary Thermal Decomposition Process (“TDP”) recycling technology, announces it has received a volume cap for an US$80 million bond from the State of Texas.

The Texas Bond Review Board issued a Certificate of Reservation, which states “The amount of US$80 million is hereby reserved for Shamrock Economic Development Corporation (“Shamrock EDC”, the Issuer) to be used for an Exempt Facility Bond (Ecolomondo Project)”.

To promote the sale of the Bond and prepare formal documentation, the Company has secured the services of Ziegler Investment Banking (investment banker), Raftelis Financial Consultants Inc. (financial consultant), Butler Snow LLP (law firm representing the Shamrock EDC), and Parker Poe LLP (law firm representing the Company).

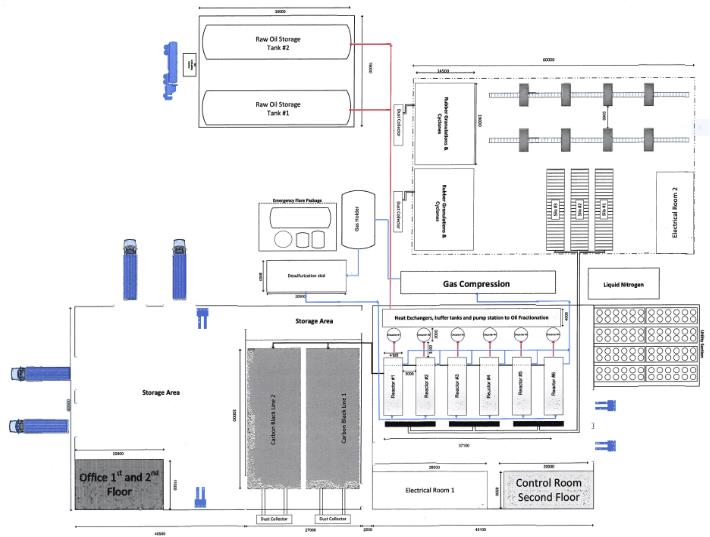

The Company plans to build and operate a six-reactor turnkey TDP facility in Shamrock, Texas. This will be the Company’s first US-based waste-to-resources TDP plant capable of processing and recycling end-of-life tires (“ELT”) into saleable recycled commercial resources for re-use. The facility construction is expected to be officially launched by the end of 2024 with completion expected during 2026. At this time, projected cost to build the Shamrock facility is projected to total approximately US $93 million, however with the experience garnered building the Hawkesbury facility, the Company is confident it can lower the cost to build.

The capital portion of the project is expected to come from a combination of a capital raise, joint venture partners, fixed assets and other considerations.

During the last 3 years, Ecolomondo has been and is still working very closely with the Shamrock Economic Development Corporation (“Shamrock EDC”, the issuer of the Private Activity Bond). The Shamrock EDC understands very clearly the local problems caused by scrap tires and the economic and environmental benefits that a 6-Reactor TDP facility will bring to the region.

Crystal Hermesmeyer, Director of the Shamrock EDC, notes that “the Shamrock EDC has tirelessly pursued the arrival of Ecolomondo, demonstrating a steadfast commitment to not only initiating but also nurturing the success of this venture for years to come. For example, through strategic collaboration with and from a subsidy from the Economic Development Administration, the Shamrock EDC spearheaded the implementation of a multi-million dollar infrastructure upgrade, including a new lift station and sewer lines. Additionally, the unwavering support from Wheeler County, exemplified by a ten-year sliding scale

abatement, ensures a smooth transition into full-scale operations post-construction with a 100% tax abatement. The City of Shamrock played a pivotal role by facilitating the installation of water lines and fire hydrants, further solidifying the foundation for Ecolomondo’s prosperous journey in Shamrock, Texas. Additionally, the Shamrock EDC has facilitated a private activity bond in the amount of US$80 million dollars, making the project highly attractive to investors due to its tax-exempt financing opportunity. The Shamrock EDC has been keenly aware of the pressing environmental issue posed by scrap tire waste in the state of Texas. With the closest disposal facilities located many hundreds of miles away, communities have been burdened with managing this pervasive problem. The Shamrock EDC has actively collaborated with other counties and municipalities in Texas to address this issue, recognizing the shared burden experienced statewide. The prospect of having a sustainable solution to this environmental dilemma is truly remarkable. Moreover, the positive impact this will have on our region and the environment is immeasurable, marking a significant step towards a cleaner, greener future for Texas and its citizens.”

Processing capabilities for the Shamrock facility is projected to be an unprecedented 5.5M per year of end-of-life tires, yielding approximately 35.1M lbs of recovered carbon black, 128,100 barrels of oil, 11.9M lbs of steel, and 10.6M lbs of syngas; roughly three times the size of the Company’s Hawkesbury (Ontario) plant output.

The Company entered last year into a binding land purchase agreement for a 136.76 acre parcel of land on I-40 in Shamrock, Texas, for the proposed plant site. In the binding agreement, the Shamrock Texas EDC has purchased the land and sold it to Ecolomondo for US $1.00 in consideration for selecting Shamrock, TX, as the location for its US launch.

Shamrock Texas Project

The Company, along with the Shamrock EDC, is in advanced discussions with feedstock suppliers of end-of-life tires. The Company is very confident and expects it will secure all feedstock needed to operate a 6-reactor facility in Shamrock county.

In addition, the Company is in final discussions with an EPC contractor to deliver a complete turnkey facility fully built and commissioned.

The Shamrock facility will serve as the Company’s flagship into the US market. Coupled with the production capacity of the Hawkesbury (Ontario) facility, the Company will produce over 21,000 metric tons of rCB per year that will be available to serve the North American market.

Ecolomondo’s strategy is to retain a controlling interest in US-based turnkey TDP facility that it builds through its US holding company, Ecolomondo Corporation U.S.A. Inc., a wholly-owned subsidiary of Ecolomondo Corporation. As with Shamrock, the Company intends to work with local, state and federal authorities to build future TDP turnkey plants throughout the US.

“We have worked for many years to develop and refine our proprietary technology. Ecolomondo now holds some of the most advanced commercially available technology and capacity for processing ELTs, and we are looking forward to this next strategic growth phase” said Eliot Sorella, President and Chief Executive Officer of Ecolomondo. “As Ecolomondo finalizes commercialization of its Hawkesbury (Ontario) TDP facility, the Company is beginning focus on its international growth plans. Ecolomondo’s strategy is to become a full-service TDP facility operator and to be a global manufacturer and vendor of recycled resources: rCB, oil, steel, fibre, and syngas”, added Mr. Sorella.

WEBINAR. The Company will have a webinar on February 8.

You can register with the following link:

https://globalonemedia.zoom.us/webinar/register/WN_26U3-TtdTlO36b2QKUVJGg#/registration

About Ecolomondo Corporation

Ecolomondo Corporation is a Canadian cleantech company that prides itself after its proprietary Thermal Decomposition technology TDP which is headquartered in Québec, Canada. It has a 25-year history and during this time has been focused on its development of its technology and the deployment of TDP turnkey facilities. TDP recovers high value re-usable commodities from scrap tire waste, notably rCB, oil, syngas, fiber and steel. Ecolomondo expects to be a leading player in the cleantech space and be an active contributor to the global circular economy. Ecolomondo trades in Canada on the TSX Venture Exchange under the symbol (TSXV:ECM) and in the United States under the symbol (OTCQB:ECLMF). To learn more, visit www.ecolomondo.com

About the Hawkesbury Plant – A 2-Reactor TDP Facility

The Hawkesbury facility building is 46,200 sq.ft and has an impressive indoor clearance of 28 feet. It is state-of-the-art and houses 4 main production departments, tire shredding, thermal decomposition, recycled carbon black refining and oil fractionation. Once fully operational, this facility is expected to process 1.3M of scrap tires per year and produce 8.7M lbs of recovered carbon black, 34,608 barrels of oil, 2.9M lbs of steel, and 2.6M lbs of process gas.

About the Shamrock Project – A 6-Reactor TDP Facility

Processing capabilities for the Shamrock facility is projected at 5.5M per year of end-of-life tires, yielding approximately 35.1M lbs of recovered carbon black, 128,100 barrels of oil, 11.9M lbs of steel, and 10.6M lbs of syngas; roughly three times the size of the Company’s Hawkesbury (Ontario) plant output. Facility construction is expected to begin by the third quarter of 2024 with completion expected by the end of the fourth quarter of 2025. Projected cost to build is approximately US $93 million.

Our Mission, Vision & Strategy

Ecolomondo’s mission is to be a contributing participant in a dynamic Circular Economy and to increase shareholder value by producing and supplying large quantities of recovered resources to be re-used in the manufacture of new products.

Ecolomondo’s vision is to be a leading producer and reseller of recovered resources by building and operating TDP facilities, strategically located in industrialized countries, close to feedstock, labor and offtake clients.

Our strategy is to become a major global builder and operator of TDP turnkey facilities, for now specializing in the processing of ELTs. Our intent is to expand aggressively in North America and Europe. Our experience and modular technology should help us get there faster and better. We plan to keep performing ongoing research and development to ensure that Ecolomondo remains technologically advanced.

ISCC Certification

ISO Certification

The Company has obtained ISO 9001:2015, ISO 14001:2015 & ISO 45001:2018 certification of its Integrated Management System (IMS), which acknowledges Ecolomondo’s commitment for quality, environmental impact and health and safety at work.

Environmental, Social & Governance (ESG)

On the social aspect the Company plans to measure global health and safety, injury rate and gender diversity, and finally in the corporate governance aspect, the Company is measuring ethics and anticorruption, ESG reporting and board independence.

About TDP

The TDP process is technically proven and more advanced than most other pyrolysis technologies. Over the years, our Technological teams were able to overcome all uncertainties that plagued most competitors especially in these areas: pre-filtration, reactor cooling, reactor rotation, water recycling, processing of rCB, (hydrocarbon removal), mass monitoring, heat curve development, humidity and water removal, safety testing, system automation, emissions control and monitoring.

TDP is Environmentally Friendly – CO2 Reduction

By producing rCB, TDP reduces GHG emissions by 90% versus the production of virgin carbon black. The production of rCB at the Hawkesbury and Shamrock facilities are expected to reduce CO2 emissions by 22,400 and 67,200 tons per year, respectively.

Please follow Ecolomondo on Twitter, Facebook, LinkedIn, Instagram and YouTube.

Twitter: https://twitter.com/EcolomondoECM

Facebook: https://www.facebook.com/EcolomondoECM

LinkedIn: https://www.linkedin.com/company/ecolomondo/

Instagram: https://www.instagram.com/ecolomondoecm/

YouTube: https://www.youtube.com/@Ecolomondo

Ecolomondo Corporation Contact

Eliot Sorella

Chairman and Chief Executive Officer, Ecolomondo

Tel: (450) 587-5999

esorella@ecolomondocorp.com

www.ecolomondo.com

Cautionary Note Regarding Forward Looking Statements

The information in this news release includes certain information and statements about management’s view of future events, expectations, plans and prospects that constitute forward looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward-looking statements. Although Ecolomondo believes that the expectations reflected in forward looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Except as required by law, Ecolomondo disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.